Helping Veterinarians with Student Loans Starts With a Good "Physical Exam"

You can borrow a variety of federal student loan types to finance your veterinary education. Some loans are disbursed directly from the federal government (Direct Unsubsidized, Grad Plus); some are federally backed but administered at the university level (Perkins, Health Professions Student Loans, Loans for Disadvantaged Students); some are directly from schools (“institutional”); some older loan types are backed by the federal government but disbursed and helped by private lenders (Federal Family Education Loans), and some are from private financial institutions. Some students borrow money from family or friends, as well.

You can find information about most of your federally-backed student loans at the Federal Student Aid website: https://studentaid.gov/. Log in to their website using the same Federal Student Aid Identification (FSA ID) that you used to apply for the loans. If it’s been a while since you borrowed, you can create an account. Federal Student Aid holds the official record of all the Title IV loans and/or grants you received over your educational career. This includes federal Direct loans, Federal Family Education Loans (FFEL), and Perkins loans.

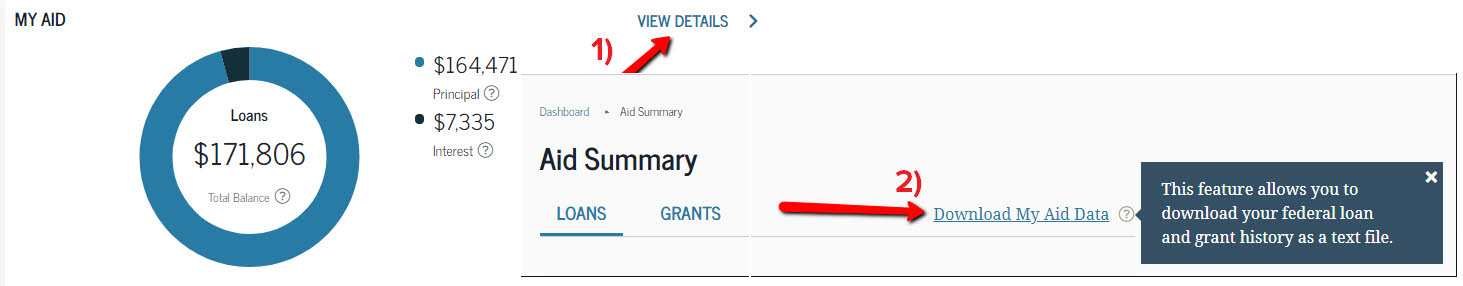

Download Your "My Aid Data" From Federal Student Aid

At the student aid website, log in and click the "View Details" link in your My Aid Dashboard. Look for the "Download My Aid Data" link on your Aid Summary page. Click that link to save a copy of your loan information as a text file (.txt) on your computer. The default name will be "MyStudentData.txt". Upload that file here so you can organize, and view important information regarding your student loans. It is the first step in helping to personalize a repayment plan for your situation. Here is a video tutorial on how to locate and download your student aid data file.

Federal Student Aid data is updated at least monthly or with specific events, like graduation or entering repayment. Therefore, it will often show different numbers than you may see in your loan servicer portal. FFEL data is inconsistently updated in the Federal Student Aid system and may be incomplete.

Upload Your Student Aid Data To The Student Debt Center

Click the "Upload My Aid Data File" button for your situation. This will open a file-chooser dialog so you can navigate to where you downloaded your TXT loan file. Select the file, and choose the "Open" action.

The upload and reporting process will take a few moments to run.

Anyone with federal student loans can use the free tools available on the VIN Foundation Student Debt Center. However, please note that all of the tools here are developed specifically for veterinary students and veterinarians. While there are many similarities across graduate school professions, the results and information provided are accurate only for those with graduate/professional school federal student loans. If you have any questions about the rules and assumptions used in the VIN Foundation Student Debt Center, please reach out to studentdebt@vinfoundation.org -- we're here to help!