Many practice owners have asked if they should apply for a PPP loan. Usually the answer to a question like this is: “it depends.” In this case it’s easier: YES, apply. No matter how your practice is doing today, you cannot be certain that will continue. Therefore, you should apply for a PPP loan.

The good news for practices is that what you spend on payroll, and a limited (up to 25%) amount, on other eligible expenses, over the 8-weeks after you receive your PPP loan can be forgiven. Under certain circumstances – largely under your control -- you will not need to pay it back!

This is also good news for your employees since the amount forgiven is tied to how many of your employees you keep employed at, or near, their current wage.

This can be beneficial whether your practice income is humming along normally, has increased, or decreased.

Let’s look at how it works:

- You apply for and get PPP loan funds.

- Your clock starts the day you receive your loan: you have 8 weeks to use the funds for eligible purposes so you can maximize forgiveness for your situation

The amount of your loan that will be forgiven depends upon how you manage your employees during your 8-week period.

- You may experience a reduction in forgiveness based upon two criteria:

- FTE reduction: If you reduce the number of employees (average Full Time Equivalents per pay period), your forgiveness amount will be reduced based on comparing your average number of FTE’s (per pay period) during your 8 week period to the average number of FTE’s per pay period during either Feb 15, 2019 through June 30, 2019, or Jan 1, 2020 through Feb 29, 2020, at your choice.

- Wage reduction: If, on a per employee basis, you reduce individual salaries during your 8 week period compared to the same individual(s) salary during the most recent full quarter by more than 25%, then your forgiveness amount will be reduced based upon how much wages have been reduced beyond the 25% threshold.

- If you are subject to a forgiveness reduction, you can reverse the reduction. There are limitations and rules to follow:

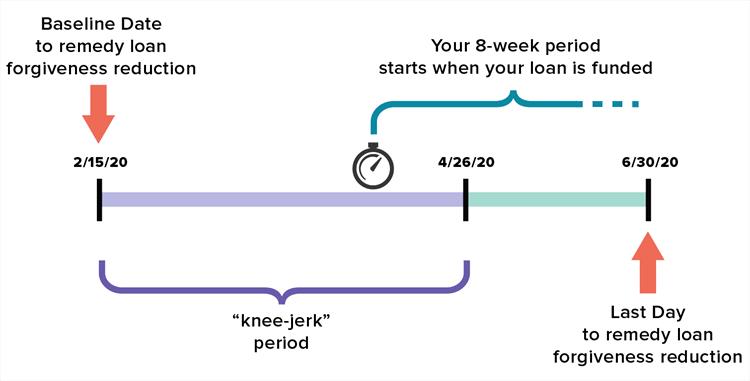

- You can reverse the reduction ONLY IF the reduced head count or wages occur between February 15, 2020 and April 26, 2020 (Rafi calls this the “knee-jerk period”). If you fire employees or reduce salaries after April 26, 2020, any reduction in loan forgiveness cannot be remedied. Why? The government is trying to incentivize you to and give you tools to keep your business open, employees working and the economy running. Whether this make sense for your business is something each employer needs to decide.

- You can “fix” any forgiveness reduction, but ONLY if:

- By June 30, 2020, you fix the reduction in FTEs during the “knee-jerk” period by calculating the reduction in FTE’s that occurred between February 15, 2020 and April 26, 2020, bringing the FTE’s back to the number they were on February 15, 2020; and

- By June 30, 2020, you fix the reduction in wages done during the “knee-jerk” period between February 15, 2020 and April 26, 2020, as compared to wages on February 15, 2020.

To re-emphasize:

- If you reduce FTEs or wages after April 26th, you can’t fix that. That doesn’t mean you shouldn’t do what makes sense for your business. It only means you won’t have 100% of your PPP loan forgiven.

- Any reduction in FTEs or wages prior to April 26th can be remedied, but only if you rectify both, by matching or exceeding your FTEs and wages on February 15, 2020, by June 30, 2020.