Repayment Assistance Plan (RAP)

The Repayment Assistance Plan (RAP) is a new income-based repayment plan introduced as part of the student loan reforms contained in the One Big Beautiful Bill signed into law on July 4, 2025.

RAP is scheduled to be available by July 1, 2026.

General Eligibility

Borrowers of Federal Direct Loans and Federal Family Education Loans (FFELs) are eligible to select RAP, except for Direct Parent PLUS loans.

Borrowers who receive a Direct Loan after July 1, 2026, will only be eligible for RAP and standard repayment options.

Borrowers who do not have a loan after July 1, 2026, are still eligible for ICR, PAYE, and IBR options.

- ICR and PAYE are scheduled to be eliminated after July 1, 2028.

- IBR was amended and will remain available for the duration of repayment for any borrower who selects it.

How RAP Works

Your income establishes a base payment amount for RAP. Base Payment Tiers for RAP using Adjusted Gross Income (AGI):

◦ Not more than $10,000 AGI: $120

◦ More than $10,000 to $20,000 AGI: 1% of AGI

◦ More than $20,000 to $30,000 AGI: 2% of AGI

◦ More than $30,000 to $40,000 AGI: 3% of AGI

◦ More than $40,000 to $50,000 AGI: 4% of AGI

◦ More than $50,000 to $60,000 AGI: 5% of AGI

◦ More than $60,000 to $70,000 AGI: 6% of AGI

◦ More than $70,000 to $80,000 AGI: 7% of AGI

◦ More than $80,000 to $90,000 AGI: 8% of AGI

◦ More than $90,000 to $100,000 AGI: 9% of AGI

◦ More than $100,000 AGI: 10% of AGI

Adjusted Gross Income (AGI) Definition: The AGI of the borrower for the most recent taxable year. For married borrowers filing separately, it does not include the spouse's AGI.

Other Income Documentation: If AGI is unavailable or does not reasonably reflect current income, borrowers may provide other documentation of income.

The applicable base payment divided by 12 results in the monthly RAP payment.

Dependents: $50 for each dependent of the borrower will be subtracted from the monthly RAP base payment.

- RAP uses the 'dependent' definition as defined under section 152 of the Internal Revenue Code of 1986. Generally, the number of dependents claimed on your recent tax return.

- For a married borrower filing a separate Federal income tax return, dependents will be limited to those that the borrower claims on that return.

Minimum RAP Payment: If the calculated monthly RAP payment is less than $10, the payment will be $10/mo.

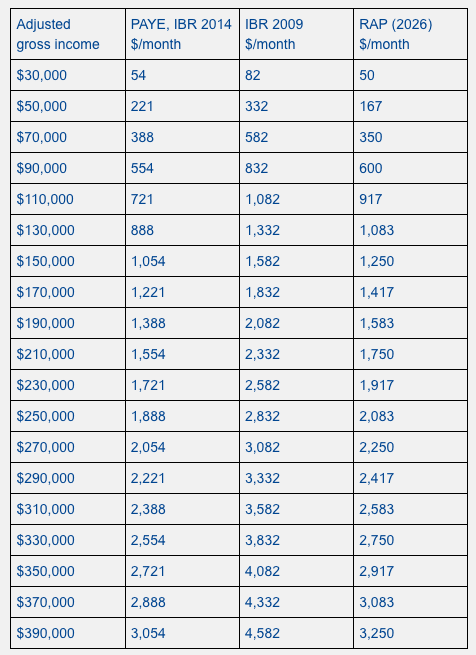

How RAP Monthly Payments Compare to other Income-Driven Plans:

Unpaid Interest

Like other federal income-driven repayment plans, your minimum monthly payment due can be less than the monthly interest accrual for your loans (also known as negative amortization).

RAP provides a 100% unpaid interest subsidy (same as SAVE did). For months where the on-time monthly payment is insufficient to pay the total interest accrued, the unpaid interest will not be charged to the borrower.

Unique to RAP, however, is a matching principal payment. For months where an on-time payment reduces the total outstanding principal by less than $50, the Department of Education will reduce the principal by an amount equal to the lesser of $50 or the total amount paid, minus the amount applied to principal.

For example, let’s say you accrue $1000/mo of interest and your minimum monthly payment is $600/mo. You will not be charged the $400 of monthly interest your payment does not cover, and you will receive the maximum $50 principal reduction for that month.

Alternatively, let’s say you accrue $1000/mo of interest and your minimum monthly payment is $10/mo because you have no or very low income. Under RAP, you will not be charged the $990/mo of interest your payment does not cover, and you will receive a $10 principal reduction that month.

Loan Forgiveness/Cancellation

RAP will cancel (forgive) any remaining balance after 360 months (30 years) of qualifying payments.

Qualifying monthly payments are any on-time monthly payments using RAP, a standard 10-year plan payment, or the required minimum payment for a previous income-driven repayment plan (ICR, PAYE, REPAYE, SAVE, or IBR).

On-time payments made under RAP also count as qualifying payments for Public Service Loan Forgiveness (PSLF).