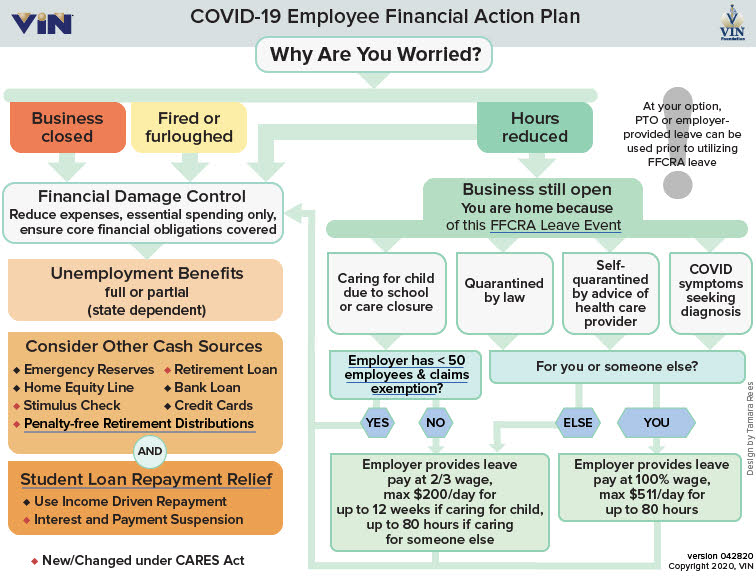

Click here to download a PDF of the COVID-19 Employee Financial Action Plan.

How to Use the COVID-19 Employee Financial Action Plan

You are an employee:

Starting at the top: Why are you worried?

- If your business has closed or you’ve been fired or furloughed

- Then you should try to reduce your expenses and

- Apply for Unemployment benefits.

- The bottom 2 boxes on the left-hand side suggest other means of obtaining cash needed to meet your expenses and receive student loan repayment relief.

- If your employer is still operating (returning to the top right):

- If your hours have been reduced by your employer:

- Some states provide for partial unemployment benefits

- If your hours are reduced or zero because of one of the four listed FFCRA Leave Events:

- If your employer has 50 or more employees, you are entitled to Emergency FMLA benefits as outlined

- If your employer has fewer than 50 employees, your employer may be exempted from providing you paid leave to care for a child due to school or care closure

Updated: 4/3/2020:

- Links to supporting documents made more obvious

- Exclusion for employers with fewer than 50 employees clarified in flowchart