CARES ACT UPDATE

The “2.0” version of the CARES Act has been signed into law. Part of the bill is known as the "COVID-Related Tax Relief Act of 2020", or COVIDTRA. You can read Rafi Moore’s quick summaries, and related board discussions, here:

Rafi Moore's CARES ACT summary can be found here.

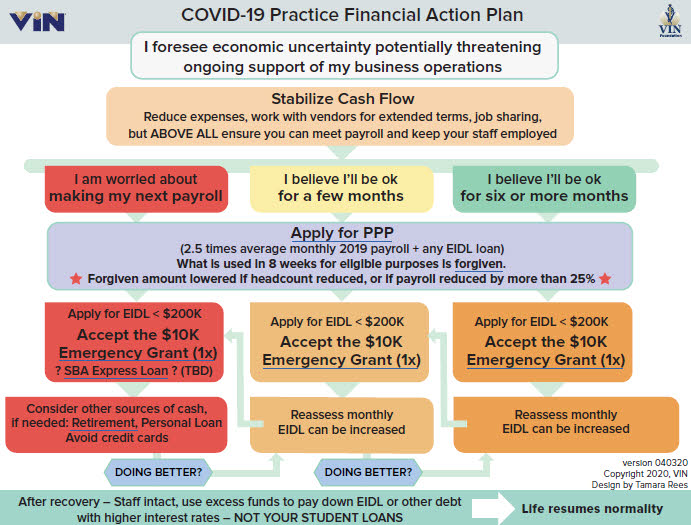

Click here to download a PDF of the COVID-19 Practice Financial Action Plan.

How to Use the COVID-19 Practice Financial Action Plan

Starting at the top: If you foresee economic uncertainty potentially threatening ongoing support of your business? (in the face of the uncertainty accompanying COVID-19, this will be true for all).

- Your first priority is to stabilize cash flow:

- Reduce expenses where you can.

- BUT – above all, ensure you can meet payroll and keep your staff employed

- This is critical if you want to remain eligible for forgiveness on your PPP (Paycheck Protection Program) loan.

- Apply for a PPP Loan: Independent of how worried you are, all practice owners, whether self-employed, sole proprietorship, or corporation should apply for a PPP loan

- When can you do this with your local SBA approved lender?

- On or after April 3 for small businesses and sole proprietorships.

- On or after April 10 for independent contractors and self-employed individuals.

- How much should you request?

- Up to 2.5 times 2019 average monthly payroll (exclude portion of any individual salary above $100,000);

- Plus any EIDL loan you have received in the past or will receive by the time your PPP loan is funded.

- AGAIN, for your PPP loan to be forgiven it is critical you maintain employee headcount and not reduce total payroll more than 25%

- How worried you are?

- If you are very tight on cash and cash flow to the point you are worried about making your next payroll:

- Apply for an EIDL loan from your local SBA approved lender.

- Accept the $10,000 Emergency Grant (you can only do this once). It is a grant you do not need to repay, though It will impact the amount forgiven on your PPP.

- Below $200,000 no personal guarantee is required

- Consider requesting an SBA Express Loan from your local approved SBA lender.

- Consider accessing other sources of cash if needed. AVOID CREDIT CARDS

- If you are in less immediate need/worry: (next two columns)

- Apply for an EIDL loan from your local SBA approved lender.

- Accept the $10,000 Emergency Grant (you can only do this once). It is a grant you do not need to repay, though It will impact the amount forgiven on your PPP.

- Below $200,000 no personal guarantee is required

- Independent of how worried you are:

- Reassess expenses, cash and cashflow monthly:

- You can apply for more EIDL loan money

Updated: 4/3/2020:

- Links to supporting documents made more obvious